How to Pick the Most Reliable Secured Credit Card Singapore for Your Demands

How to Pick the Most Reliable Secured Credit Card Singapore for Your Demands

Blog Article

Revealing the Opportunity: Can People Discharged From Insolvency Acquire Credit Score Cards?

Comprehending the Effect of Bankruptcy

Bankruptcy can have an extensive impact on one's credit rating, making it testing to access credit scores or finances in the future. This monetary tarnish can stick around on credit report reports for a number of years, impacting the person's capacity to secure beneficial rate of interest rates or monetary opportunities.

Additionally, insolvency can limit job opportunity, as some companies conduct credit history checks as component of the working with process. This can posture a barrier to individuals looking for brand-new task prospects or occupation advancements. Overall, the influence of bankruptcy extends past financial restraints, affecting different aspects of a person's life.

Aspects Impacting Charge Card Authorization

Following insolvency, people often have a low credit rating due to the unfavorable impact of the personal bankruptcy declaring. Credit report card companies usually look for a credit history score that shows the applicant's capacity to handle debt properly. By carefully thinking about these factors and taking steps to restore credit rating post-bankruptcy, individuals can improve their potential customers of obtaining a credit rating card and functioning in the direction of financial recovery.

Actions to Rebuild Debt After Bankruptcy

Restoring credit scores after insolvency calls for a critical technique concentrated on monetary self-control and consistent debt management. The very first step is to examine your credit scores report to ensure all financial obligations included in the personal bankruptcy are properly mirrored. It is important to establish a budget that prioritizes financial debt repayment and living within your means. One reliable technique is to acquire a secured credit scores card, where you transfer a specific quantity as security to develop a credit scores limitation. Timely payments on this card can demonstrate liable credit history use to prospective lenders. Additionally, consider ending up being an authorized customer on a member of the family's bank card or exploring credit-builder fundings to further improve your credit rating rating. It is vital to make all settlements in a timely manner, as payment history significantly affects your credit rating. Patience and determination are crucial as restoring debt takes some time, yet with dedication to appear monetary techniques, it is feasible to improve your credit reliability post-bankruptcy.

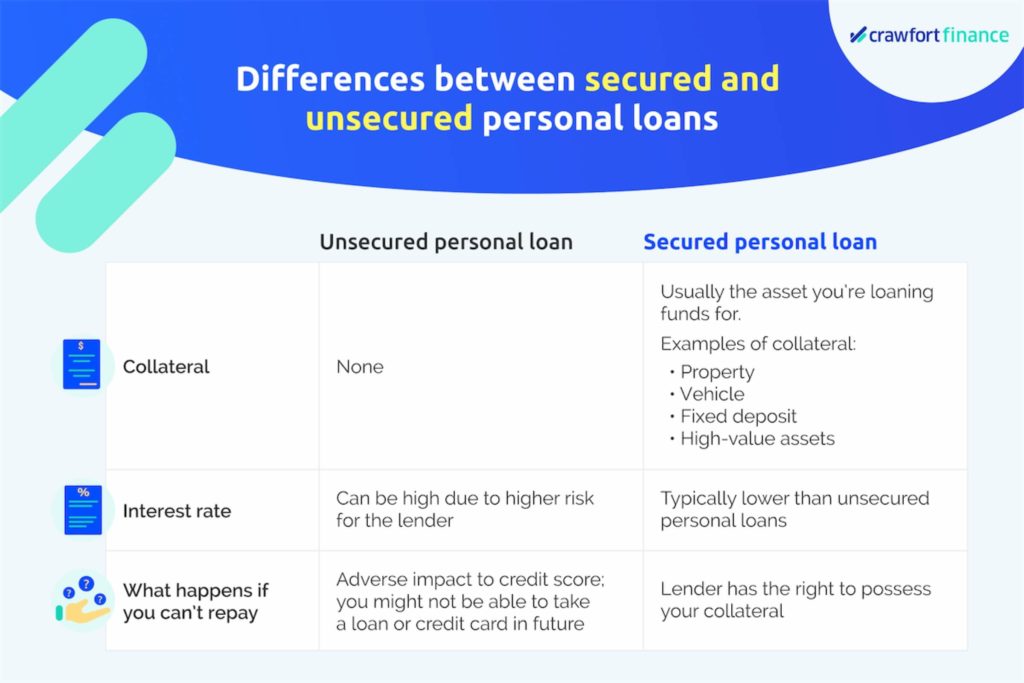

Safe Vs. Unsecured Credit Cards

Complying with personal bankruptcy, people usually take into consideration the choice between safeguarded and unprotected charge card as they intend to restore their credit reliability and monetary stability. Protected bank card need a money down payment that acts as collateral, normally equal to the credit rating restriction given. These cards are easier to acquire post-bankruptcy considering that the down payment decreases the threat for the provider. Nevertheless, they might have greater fees and rates of interest contrasted to unsecured cards. On the other hand, unprotected credit cards do not require a down payment yet are tougher to certify for after bankruptcy. Providers analyze the applicant's credit reliability and might use reduced charges and passion rates for those with an excellent economic standing. When making a decision between the two, individuals should weigh the advantages of much easier authorization with protected cards versus the possible costs, and take into consideration unsafe cards for their long-term monetary goals, as they can help reconstruct credit without binding funds in a down payment. Eventually, the option between safeguarded and unsafe credit score cards must align with the individual's financial purposes and ability to handle credit report sensibly.

Resources for Individuals Seeking Credit History Rebuilding

For people aiming to boost their credit reliability post-bankruptcy, exploring readily available sources is crucial to effectively navigating the debt rebuilding procedure. secured credit card singapore. One important resource for individuals looking for credit scores rebuilding is credit scores counseling agencies. These companies use economic education, budgeting assistance, and customized credit score enhancement plans. By dealing with a credit rating therapist, people can gain understandings into their credit history records, discover methods to boost their credit report scores, and get support on handling their funds successfully.

One more valuable source is credit scores monitoring services. These go right here services enable people to maintain a close eye on their credit rating records, track any adjustments or mistakes, and find possible indicators of identity burglary. By checking their credit history on a regular basis, people can proactively resolve any kind of concerns that might make sure and browse around these guys emerge that their credit rating info is up to day and precise.

Moreover, online devices and resources such as credit report simulators, budgeting applications, and economic literacy internet sites can supply individuals with valuable details and tools to assist them in their debt restoring journey. secured credit card singapore. By leveraging these sources effectively, people released from insolvency can take significant steps towards improving their credit scores wellness and securing a better economic future

Verdict

To conclude, people discharged from insolvency may have the opportunity to get bank card by taking actions to restore their credit history. Variables such as credit report earnings, debt-to-income, and history proportion play a significant role in bank card approval. By recognizing the influence of bankruptcy, selecting between safeguarded and unprotected credit rating cards, and utilizing resources for credit history restoring, people can improve their credit reliability and potentially get access to debt cards.

By functioning with a credit report counselor, people can get understandings right into their credit history records, discover approaches to increase their credit score ratings, and obtain support on managing their financial see post resources efficiently. - secured credit card singapore

Report this page